The purchase of the inventory (above) was originally recorded in COGS and remains there without adjustment. In contrast, balances reported by periodic and perpetual LIFO frequently differ. We’ll use a simplified example where ABC Widgets buys and sells only one widget during a given accounting period.

- At the end of the accounting year the Inventory account is adjusted to equal the cost of the merchandise that has not been sold.

- The time commitment to train andretrain staff to update inventory is considerable.

- If the bookstore sold the textbook for $110, its gross profit using periodic LIFO will be $20 ($110 – $90).

- In a periodic LIFO system, inventory records are only updated at the end of a reporting period.

- The integration of inventory systems within supply chain management is essential for maintaining the delicate balance between demand and supply.

- This average cost is then applied to the units sold during the year and to the units in inventory at the end of the year.

Inventory and Cost of Goods Sold Outline

Total cost was $470 ($110 + $360) for these four units for a new average of $117.50 ($470/4 units). The applicable average at the time of sale is transferred from inventory to cost of goods sold at points A ($110.00), B ($117.50), and C ($126.88) below. The method of inventory accounting chosen by a company can also influence tax liabilities. For instance, in some jurisdictions, LIFO can lead to a lower taxable income in times of inflation, as it assumes that the most recently acquired inventory, which may be more expensive, is sold first.

What is an example of a perpetual inventory system?

As stated earlier, these numbers are all fairly presented but only in conformity with the specified principles being applied. Two bathtubs were sold on September 9 but the identity of the specific costs to be transferred depends on the date on which the determination is made. A periodic system views the costs from the perspective of the end of the year, while perpetual does so immediately when a sale is made. Overall, once a perpetual inventory system is in place, it takes less effort than a physical system.

Using Different Inventory Valuation Methods

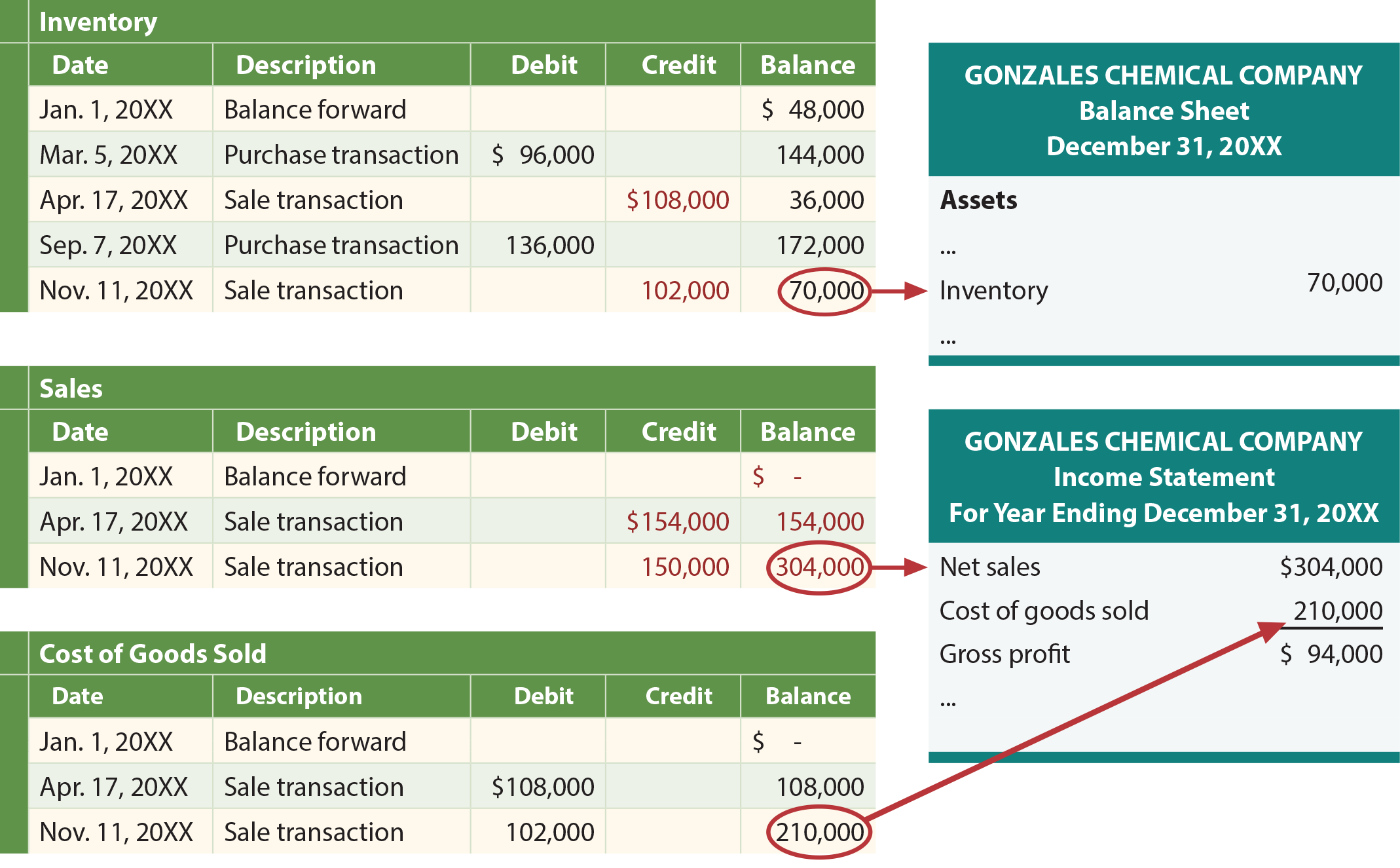

The average method can be applied on a perpetual basis, earning it the name moving average. This technique is involved, as a new average unit cost must be computed with each purchase transaction. The following table, ledgers, and financial statements reveal the application of moving average. However, the need for frequent physical counts of inventory cansuspend business operations each time this is done. There are morechances for shrinkage, damaged, or obsolete merchandise becauseinventory is not constantly monitored.

In a perpetual LIFO system, the last costs available at the time of the sale are the first that software moves from the inventory account and debits from the COGS account. See the example LIFO perpetual inventory card below to get an idea of how it works. The retail sales for this product in this company were $25,000 from Jan. 1, 2019 to Jan. 15, 2019.

Perpetual Average

This nuanced interplay between inventory management and financial reporting underscores the importance of meticulous record-keeping and strategic decision-making in inventory accounting practices. Small- and medium-sized companies or those with small physical inventories continue to use the periodic inventory system, though many are opting for low-cost perpetual inventory systems. A perpetual inventory system uses point-of-sale turbotax live 2021 terminals, scanners, and software to record all transactions in real-time and maintain an estimate of inventory on a continuous basis. A periodic inventory system requires counting items at various intervals, such as weekly, monthly, quarterly, or annually. The first in, first out (FIFO) method assumes that the oldest units are sold first, while the last in, first out (LIFO) method records the newest units as those sold first.

One of the main differences between these two types of inventory systems involves the companies that use them. Smaller businesses and those with low sales volumes may be better off using the periodic system. In these cases, inventories are small enough that they are easy to manage using manual counts. In a periodic LIFO system, inventory records are only updated at the end of a reporting period. If the bookstore sold the textbook for $110, its gross profit using periodic LIFO will be $20 ($110 – $90). If the costs of textbooks continue to increase, periodic LIFO will always result in the least amount of profit.

The difference between the methods is the timing of when the inventory cost is recognized, and the cost of inventory sold is posted to the cost of sales expense account. But keep in mind, results can differ when more purchases and sales are made throughout the period, especially when prices change. Perpetual LIFO could lead to different COGS and ending inventory values than Periodic LIFO, because it continuously updates with each transaction. It can be cumbersome and time-consuming, as it requires you to manually count and record your inventory. It also isn’t as up to date as a perpetual system, as it is done at periodic intervals rather than continuously.

FitTees conducts a monthly physical count to determine existing goods on hand. Since we are using the periodic system, we don’t make a journal entry to record the COGS. As can be seen here, periodic and perpetual LIFO do not necessarily produce identical numbers. When deciding how to maintain control over physical inventory, it’s prudent to carefully weigh both the pros and cons of any system under consideration.